Personal Savings

Tuck it away for a rainy day or save for your future with an IRA. Future you will thank you. Firelands Federal Credit Union has the personal savings strategies to advance your dreams.

What You Get When You Open a

Share Savings Account

-

Gain membership to Firelands Federal Credit Union

-

Earn competitive dividends on balances of $100 or more

-

Dividends compounded daily and paid quarterly

-

Avoid the $5 minimum balance fee by maintaining a $100 minimum daily average balance

-

Unlimited withdrawals (6 unsigned transfers allowed per month)

-

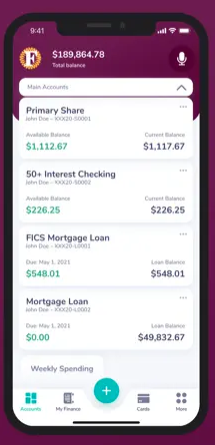

Free digital banking

-

Surcharge-free ATMs and Shared Branching available

-

$5 minimum deposit to open

-

FREE eReceipts

Ready to open your Share Savings Account?

Round Up Savings

Put a little extra change in your pocket with Firelands Federal Credit Union’s Round Up & Save Program.

Every time you use your Visa® debit card purchase, we will round your purchase amount up to the next whole dollar and deposit the difference into your savings account of choice.

Round Up Savings earn a higher dividend rate than our regular Share Account for balances of $25.00 and up!

Log in to Online or Mobile Banking, tap the + button, select Create New Share, and choose Round Up Saver.

(All deposits to the Round Up Savings Account come from rounded up debit card transactions. Outside cash deposits or transfers to this account are not available.)

What You Get When You Open a

Youth Savings Account

-

Available to young savers up to 12 years old

-

Competitive dividends on balances of $5 or more

-

No monthly service fees

-

No minimum balance requirements

-

Choose a gift from the Treasure Chest with every deposit

-

Quarterly youth newsletter

-

Youth activities held throughout the year

-

Special Term Share Certificate rates

-

Free digital banking

-

Surcharge-free ATMs and Shared Branching available

-

$5 minimum deposit to open (Must show proof of Social Security Number, Passport, or other acceptable government-issued ID to open account.)

-

Available to teens ages 13-17 years old

-

Competitive dividends on balances of $5 or more

-

No monthly service fees

-

No minimum balance requirements

-

Special Term Share Certificate rates

-

Free digital banking

-

Surcharge-free ATMs and Shared Branching available

-

$5 minimum deposit to open

-

Checking account

-

Visa® ATM/debit card — limit varies based on age

-

$200 limit ages 13-15

-

$300 limit ages 16-17

-

You may apply for a Visa credit card with a limit of $100-$200 (a qualified parent or legal guardian co-signer is required).

-

You may apply for a Smart Start Teen Club Loan for $50-$500 for up to 12 months at 1.50% below our signature loan rate (a qualified parent or legal guardian co-signer is required).

Ready to open your Youth Savings Account?

Firelands FCU, in partnership with FamZoo, offers debit cards for kids and teens—making money management simple for them and stress-free for you!

Use online, in stores, and abroad with EMV chip technology, Apple Pay support, Mastercard® Zero Liability Protection, and FDIC insurance.

The FamZoo app gives you and your child a personalized dashboard, one for them, one for you. They swipe their debit card, you set the limits. They check off chores, you automate allowance. They learn to save, spend, and give wisely while you coach, cheer, and keep them on track.

Any number of children. Any number of cards. Just $1.99 per account per month.

With help from the Ohio Treasurer’s Office, Firelands FCU offers this tax-advantaged savings account to help you reach your homeownership goals faster!

![]() Earn 7.25% APY*, one of the best rates around, to supercharge your savings.

Earn 7.25% APY*, one of the best rates around, to supercharge your savings.

![]() Receive a deposit match up to $250 just for keeping your account open and active for 90 days.**

Receive a deposit match up to $250 just for keeping your account open and active for 90 days.**

![]() Score $500 toward closing costs when you finance your mortgage with Firelands FCU.***

Score $500 toward closing costs when you finance your mortgage with Firelands FCU.***

![]() Must be an Ohio resident age 18 or older.

Must be an Ohio resident age 18 or older.

![]() Deposit between $500 and $100,000.

Deposit between $500 and $100,000.

![]() Account must be kept open for a minimum of 6 months.

Account must be kept open for a minimum of 6 months.

![]() Only one account can be open per individual across all financial institutions.

Only one account can be open per individual across all financial institutions.

![]() Funds must be utilized within 5 years for the purchase of a home in Ohio.

Funds must be utilized within 5 years for the purchase of a home in Ohio.

![]() Individuals are required to review the Ohio Homebuyer Plus participation statement before opening an account through the program.

Individuals are required to review the Ohio Homebuyer Plus participation statement before opening an account through the program.

![]() Accounts connected with Ohio Homebuyer Plus must be used within five years, maintain a minimum balance of at least $500, and cannot exceed a maximum balance of $100,000.

Accounts connected with Ohio Homebuyer Plus must be used within five years, maintain a minimum balance of at least $500, and cannot exceed a maximum balance of $100,000.

Stop into your Firelands FCU branch TODAY to fill out an application or get connected to a member of our team by clicking the button below!

What You Get When You Open a

Christmas Club Account

-

Save year-round for the holidays

-

Make deposits at any time, in any amount you feel comfortable with

-

No monthly service fees

-

Take advantage of your higher balance with tiered rates

-

Watch your rate grow with your balance

-

Dividends compounded daily and paid annually on September 30th

-

Funds automatically transferred to your checking or savings account on Oct. 1st

-

$5 minimum deposit to open

Ready to open your Christmas Club Account?

Name Your (Share) Savings

With a Name Your Savings Account, you can personalize your savings journey by naming your account after a specific financial goal!

Whether it’s saving for a dream vacation, a new car, or a down payment on a home, your savings account reflects your aspirations. Say goodbye to generic account names and hello to personalized motivation.

Just log into Digital Banking, online or through the Firelands FCU mobile app, tap the + button, and select Create New Share. Then choose Name Your Club and personalize it to match your goal!

High-Yield Savings

Looking to grow your money faster? Our Money Market Accounts and Share Certificates do just that! Whether you want flexible access with tiered rates or a guaranteed return over time, these options help you earn more while doing less. It’s saving—supercharged. Let your money work smarter, not harder.

What You Get When You Open a

Money Market Account

-

- Competitive, tiered rates on balances of $5,000 or more

- Higher balances earn higher rates

- Dividends compounded daily and paid monthly

- No monthly service fees

- Unlimited withdrawals (6 unsigned transfers allowed per month)

- View Rates

Ready to open your Money Market Account?

Money Market Calculator

What You Get When You Open a

Share Certificate

-

- Fixed rates, higher than regular savings

- Receive higher rates by selecting a longer term

- Provides more guarantee than risky market investments

- A wide range of terms available (from 6 to 60 months)

- No setup or maintenance fees

- Early withdrawals subject to penalty

- Youth certificates and limited-time certificates available; check our rates to learn more

- Minimum deposit to open varies by certificate

- Dividends compounded and paid quarterly

- View Rates

Ready to open your Share Certificate?

Share Certificate Calculator

What You Get When You Open a

Individual Retirement Account (IRAs)

-

Competitive dividends above standard savings rates

-

Traditional and Roth IRA options

-

No setup fees

-

No monthly or annual maintenance fees

-

$5,500 contribution limit per year

-

Additional $1,000 "catch-up" contribution allowed for ages 50+

-

Funds can be used to purchase certificates within IRA

-

Funds can be used to purchase certificates within IRA

-

$500 minimum deposit to open

Traditional vs. Roth

There are advantages to both Traditional and Roth IRAs. One of the biggest differences is the time at which you see the most advantage. A traditional IRA provides potential tax relief today, while a Roth IRA has the potential for the most tax benefit at time of retirement.

-

No income limits to open

-

No minimum contribution requirement

-

Contributions are tax deductible on state and federal income tax

-

Earnings are tax deferred until withdrawal (when usually in lower tax bracket)

-

Withdrawals can begin at age 59 ½

-

Early withdrawals subject to penalty

-

Mandatory withdrawals at age 70 ½

-

Income limits to be eligible to open Roth IRA (Consult a tax advisor)

-

Contributions are NOT tax deductible

-

Earnings are 100% tax free at withdrawal (Subject to some minimal conditions. Consult a tax advisor)

-

Principal contributions can be withdrawn without penalty

-

Withdrawals on interest can begin at age 59 ½

-

Early withdrawals on interest subject to penalty (Certain exceptions apply, such as healthcare, purchasing first home, etc.)

-

No mandatory distribution age

-

No age limit on making contributions as long as you have earned income